June 11, 2020

CEI's Mission-Driven Advice and Financing Helps Small Businesses Manage through the COVID Pandemic

June 11, 2020 (Brunswick, ME) – Small businesses are the core of Maine’s economy. In 2019, businesses defined by the U.S. Small Business Administration (SBA) as “small” (with fewer than 500 employees) made up 99 percent of all Maine Business and employed over half of the State’s workforce[i]. When the COVID-19 pandemic forced many small businesses to close their doors in response to health concerns and state guidelines, the impact was felt immediately.

As Maine’s largest CDFI, Coastal Enterprises, Inc. (CEI) shifted overnight to address the urgent challenges faced by our business advice and loan clients.

Within days of the first COVID-19 case in Maine, CEI developed an online library with information on best practices and state and federal resources for small businesses. We also launched a webinar series to walk existing and new clients through the maze of federal, state and local regulations and relief programs.

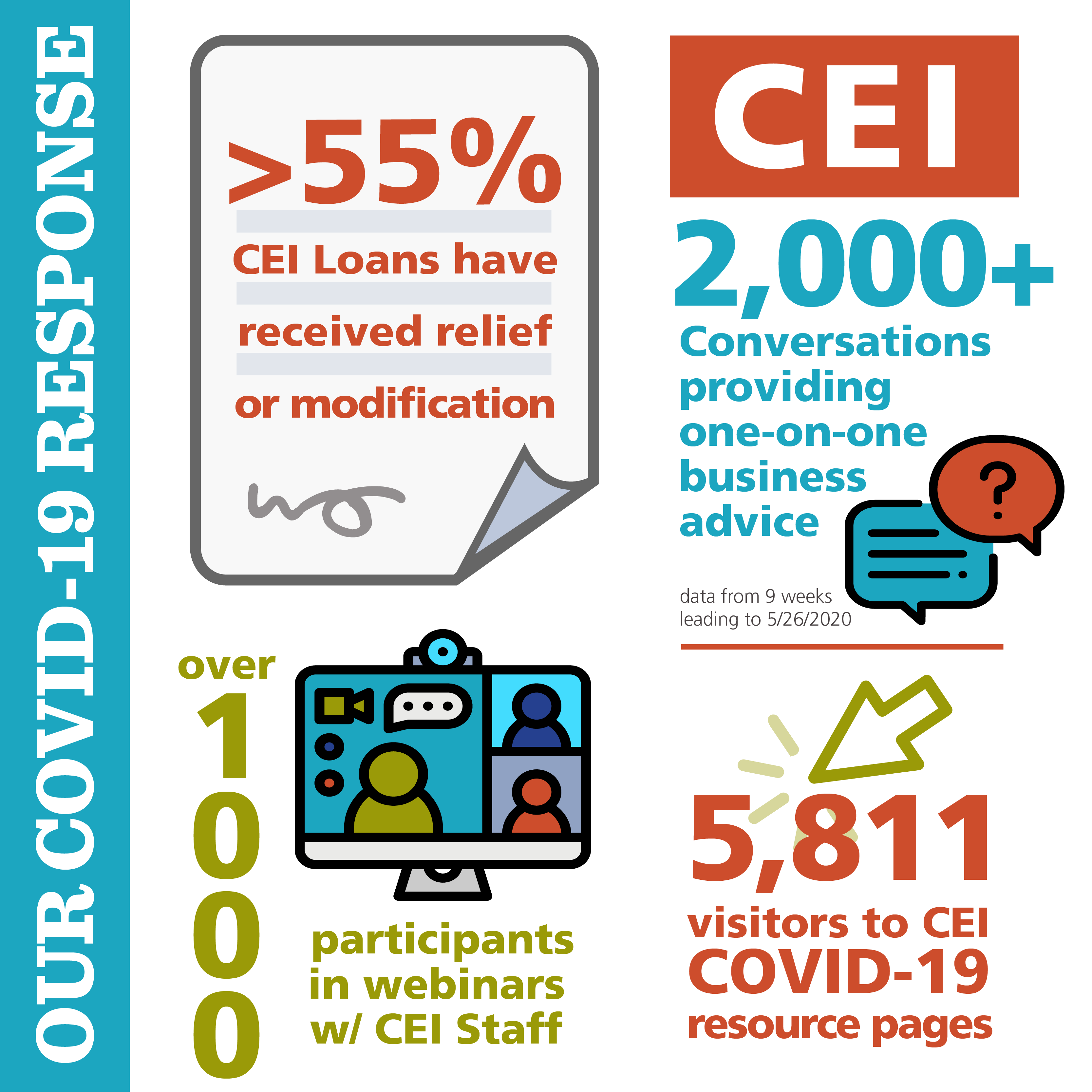

In the first two months of the pandemic, CEI business advisors held over 2,000 individual coaching sessions with small-business owners—almost double the number they provide in a typical year. CEI’s lending team worked closely with borrowers, making modifications to over 50 percent the loans in our portfolio.

Some immediate loan relief was provided through a federal program for SBA microloans, which account for 72 loans in CEI’s portfolio. However, CEI staff members quickly realized that program didn’t address the needs of many other borrowers. They got to work, fundraising to fill in the gap for those businesses.

Small farms make up an important part of Maine’s local food system in our rural state, but farms were ineligible for many of the federal COVID relief programs when they were introduced. A $100,000 grant from the Henry P. Kendall Foundation allowed CEI to provide three months of debt relief covering principal and interest payments for all the farms in our portfolio.

The grant funds eased up-front financial burdens, giving farmers the flexibility they needed to pivot from models that largely depended on sales to restaurants and institutions (many of which were currently shuttered) to a more direct to consumer model, which was seeing a sudden increase in demand. With limited orders from longtime restaurant and catering customers, Flying Goat Farm in New Gloucester, Maine, is piloting a home milk and dairy delivery service and partnering with another local farm to provide other staples such as bread, eggs and soap. They are also exploring options for building a small farm stand onsite. In the words of Flying Goat owners Devin Shepard and Cara Sammons-Shepard, “Being able to shift funds away from this (CEI) loan for a short period of time is going to expedite that [pivot] timeline and make it more likely that our farm will be able to reestablish cash flow more quickly. “

Another subset of business owners who are not able to access federal relief are CEI’s fee-for-service loan borrowers, all of whom immigrated to Maine from countries outside the U.S. These business owners are prohibited by their religious practices from paying interest. CEI solves this issue by offering a fee-for-service, Sharia-compliant product. In order to match what is being offered to the SBA microloan borrowers, CEI raised funds from local banks, businesses and nonprofits to cover six months of principal and interest payments for fee-for-service microloan borrowers.

Most recently, in response to client feedback that existing relief programs don’t cover key business expenses, like rent, insurance and/or outstanding invoices for supplies, CEI developed the Wicked Reboot loan for working capital needs or operating expenses. This three-year, three percent loan of up to $30,000 is designed to work in tandem with federal relief programs and is available to businesses whether or not they received PPP or EIDL funding. The SBA will cover the first six months of principal and interest payments.

Because CEI works so closely with thousands of entrepreneurs in our community, we know their specific needs and challenges. This allows CEI to tailor supports, as was the case with farms and fee-for-service borrowers, the unemployment webinars developed specifically for childcare providers and the numerous solo-entrepreneurs receiving individualized, one-on-one coaching. This local, mission-driven knowledge is why CDFIs play a vital role in helping entrepreneurs launch and grow businesses in underserved areas. As small businesses weather the economic impacts of COVID-19, CDFIs like CEI are on the front line, dedicated to making sure that local economies recover.

[i] https://cdn.advocacy.sba.gov/wp-content/uploads/2019/04/23142650/2019-Small-Business-Profiles-ME.pdf